No Bars, No Benefit

Why a MrBeast Phone Company Is the Wrong Kind of Creator Power

TL;DR: Know your customer — the bill payer, not the fan. A creator-branded MVNO is a commodity reseller in a saturated market with high churn and a buyer mismatch (kids don’t pay the bill — parents do). Cable MVNOs win because they’re bundled with something households already buy; creator MVNOs don’t have that moat. Meanwhile, the regulatory/ops grind (E911, porting, CPNI, STIR/SHAKEN, taxes/fees) is everything creators shouldn’t be doing. Mint worked when it won on price and distribution — and then got absorbed by the network. This is distraction risk, not durable leverage.

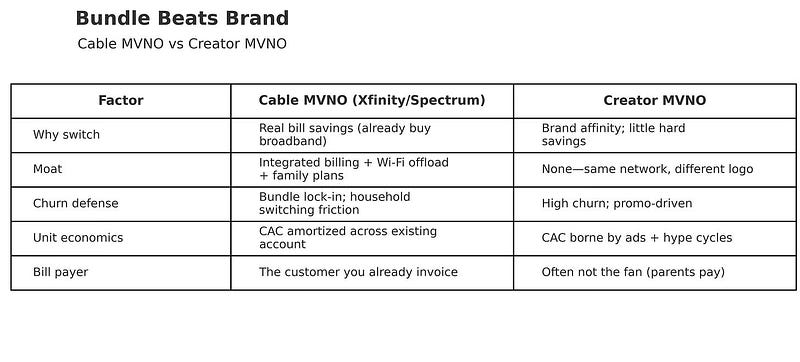

The clearest picture: bundle beats brand

Why it matters: Comcast and Charter keep posting big mobile line adds off the back of their internet base. That’s a structural advantage, not a marketing trick.

What’s actually happening

- Reports say MrBeast is exploring an MVNO with a 2026 target window based on a leaked investor deck seen by multiple outlets.

- The buyer mismatch is obvious: huge Gen Z reach, but parents pay the phone bill.

- We’ve also seen a wave of celebrity MVNOs this year. Launching is easy; sustaining is the hard part.

Why the numbers don’t love this

- Churn is relentless. U.S. prepaid churn is materially higher than postpaid — think multiple percentage points per month. That’s a leaky bucket a fan brand has to refill forever.

- Even if you capture 1% of the audience… Even if you converted 1% of a ~300M audience (~3M lines), at ~3% monthly churn you’d lose ~90,000 lines every month. At a conservative ~$200 CAC, that’s ~$18M/month just to stand still — before support, promos, or device incentives.

- Parents ≠ fans. The decision-maker is often mom/dad. That tanks conversion, no matter how strong the brand.

- With ACP subsidies gone: Since June 2024, many price-sensitive families lost $30/month in ACP support — making any creator premium even harder to justify.

- Mint wasn’t magic — price + scale were. Mint won on ruthless value and D2C efficiency — then T-Mobile closed the acquisition and pulled it into owner economics. That’s not a template a solo creator can copy without carrier-level scale.

The part no one puts in a hype deck: the regulatory/ops slog

Running a phone service — even as a reseller — means inheriting headaches your audience will blame you for:

- Number porting SLAs: Simple ports in one business day; miss it and you eat the heat.

- E911 & location rules: You own compliance obligations because subscribers dial 911 through your brand.

- Robocall/STIR-SHAKEN & mitigation: Providers must register and maintain an active program.

- CPNI privacy regime: Annual certifications and breach notifications.

Creators trade narrative equity for call-center tickets here — and every outage, port delay, or 911 complaint lands on the brand.

The realistic best-case (still underwhelming)

Best-case, this devolves into a marketing skin on a major carrier: outsourced BSS/OSS, eSIM activation, periodic giveaways. As a sponsorship, fine. As an owned business, you inherit low margins, seasonal promo spend, and constant churn. Cable MVNOs can subsidize with bundle economics; creator MVNOs can’t.

Know Your Customer

Creators keep mistaking the audience for the customer. A phone plan is bought by the bill payer — usually a parent — who optimizes for price, reliability, family plans, and one-bill simplicity. If you don’t control a bundle that lowers their bill or reduces their hassle, your brand is just a label on someone else’s network. Durable leverage comes from value layers you own — identity, community, and bundles parents actually want — not from reselling connectivity.